Have you always wanted to invest, but didn’t really know where to start? Perhaps you wanted to invest but didn’t have the minimum account balance required by a financial services company that you were considering.

Just because you are not already wealthy doesn’t mean you shouldn’t invest. It just means you need to invest a little differently. Fortunately, that is now easier than ever thanks to robo advisors such as Wealthsimple.

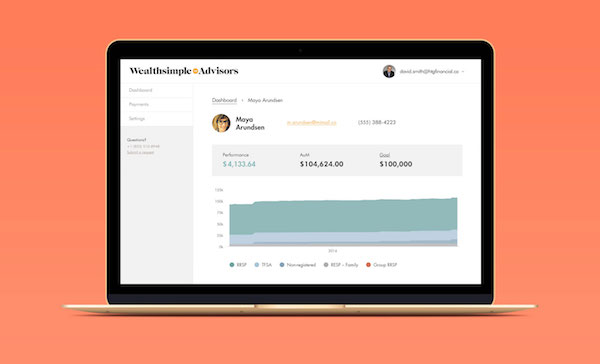

Instagram/@wealthsimple

How Does the System Work?

The company utilizes a technology that is quickly becoming popular in the finance field. They utilize robo advisors. These are automated advisors that will take the money that you have invested and then divvy it up between various investment options that correlate with your investment risk tolerance and the strategy that you have agreed to for your investments. If you were to put $1,000 into the account, the robo advisor would then split that up amongst several companies or types of accounts, which helps to diversify your portfolio.

This is the same sort of thing that an actual person would do, but everything is automated and simpler here. It does away with hard work on your part because you do not have to do any of the research or move any of the money around. Of course, this does not mean you won’t have access to actual people! You will still find the customer service department and people who can answer questions you might have and alleviate any concerns.

Is the System Safe?

One of main questions people have when they are considering working with a robo advisor, or just about any company online for that matter, is whether it is safe or not. While there is always a risk with the security of anything that is on the internet, you will be happy to know that Wealthsimple features 128-bit SSL certificate encryption that is considered by them to be bank-level security. The company utilizes backups and firewall technology, which can help prevent problems from occurring for their customers and on their site. Thus far, the company has not had any security problems and overall, they seem to be a safe company with which to do business.

Instagram/@wealthsimple

The Main Benefits of Working with Wealthsimple

What is it about this company that makes it a good choice? Why would you choose this company over any of the others in Canada? For starters, you’ll find this is the largest robo advisor in the country, and this gives them experience that others simply don’t have. In addition, one of the best features is that you will have a very low account minimum. In fact, the account can be as low as $0.

The platform is easy to use and is well-designed, the company will pay transfer fees, it is simple to sign up even through the app, and the company has a partnership with Mint.co, which makes it easier to track your investing and budgeting. There are plenty of reasons to consider using the company to help make your investing life much easier. However, you will want to note that even though the company has very low fees, they are not the lowest on accounts under $100,000.

Consider Getting Started

As you can see, there are some very good reasons to consider using Wealthsimple as a means to help with your investments. You do not need an account balance, it is very simple set up, and you invest money when you have it. This is a very convenient way to get more and more people to start investing.

Featured Image: pxhere

Articles You Might Be Interested:

How I Made $800 In Two Weeks Using Carousell

5 Important Questions To Ask To Get Ahead In Your Finances

How To Pick The Right Credit Card For You

7 Pro Tips For Saving Money Every Time You Shop Online

How To Save Money Without Giving Up Shopping

We’re constantly on the lookout for apps and websites that will allow us to save even money while living in this expensive city. We’ve come up with a list of our top apps/websites that are free, and give us rewards just for using them. We hope you benefit from the list below as much as we have. Save a lot of money with very little effort!

Paytm Canada

Paying bills is something that we all have to do. We know it sucks, but it’s part of being an adult and it’s just one of those things that if you don’t stay on top of, can cause you major issues down the road. This is where the Paytm Canada app comes into play. They are a Canadian based tech company that makes your life easier by consolidating all your bills into one easy to use app. For every transaction that you make using the App, you will collect Paytm points which you can redeem for an e-gift card from popular brands.

Biko

This is for all of you cyclers out there! The Biko app is available for Android or iPhone and rewards you for improving your health, the environment, and your city. Once you turned on the app and start your activity, the GPS will track every kilometre you ride, and you’ll receive one Biko per kilometre. Once you’ve hit 5 kilometres (or 5 Bikos), you can start to redeem! Rewards include free coffee, brewery tours, beer flights, food deliveries, and discounts at Toronto restaurants, workout classes, bike shops, online stores, and so much more.

Ebates.ca

Big into online shopping? This is the website for you. With over 750 stores to choose from, why wouldn’t you use this website to get some cash back on everything you buy? You were going to make those purchases anyways, right? Might as well save some money if you can. From stores such as Apple, Gap, Sephora, eBay, Amazon, along with so many others, you’ll see your cash back add up quickly. And if you sign up using this referral code, you get $5 cash back as a starter sign up bonus.

Minicard Toronto

This is my newest go-to site for finding information and discounts for fun things to do around the GTA. Minicards are small, credit-card sized informational guides that provide tourists and locals with discounts for museums, attractions, restaurants, retail stores, transportation (10% off of Via!), and so much more. Heading to Second City or the Ripley’s Aquarium? Hitting up Salad King for some yummy Thai food? Head over to Minicard Toronto to download your discount card and start saving. You can also find the physical Minicards in tons of downtown hotel lobbies, condos, apartments, tourism centers, universities, ESL centers, and airport terminals.

Checkout 51

Hello? Any coupon collectors out there? Since we’re already buying toiletries, household items, and groceries, we might as well start saving some money on it. Checkout 51 is a mobile couponing app that provides users with a new list of offers every week. When you buy a product on offer, take a picture of your receipt, tick off the coupon that you are claiming, and your account will be credited with the offer amount. It’s that easy. And you’ll see your savings add up fast. Once you’ve collected $20 worth of savings, you can request a cheque in the mail!

Drop

Launched in 2015, this new Toronto startup will supercharge your credit and debit cards just by linking them to the Drop app. You’ll collect drop points when you buy your morning coffee, head to your favourite restaurant, or hit up the coolest events in the city. And it does it for you automatically so you don’t have to do a thing besides register. You can build your own Drop program with personalized offers that will get you more points when you spend at those stores. And when you’ve collected enough Drop points, you can redeem them towards all rewards across the Drop program. High fives all around for Drop.

What are some other apps or websites to score free stuff? Share them in the comment section.

Posts you might be Interested in:

A Forbes 30-under-30 CEO Shares 5 Apps that will actually Make you Money

Why Ebates is the Best Money-Saving Site Online Right Now

35 Money-Saving Websites you Need to Know

How I Saved $20,000 in One Year While Living in Toronto

The Best Ways to Save Money in Toronto this July

I’ve struggled with the idea of a 9-5 job for a large part of my adult life. I’ve tried it before, but I just don’t think it’s for me. When you don’t have a steady income, it’s imperative to work as much as possible so you can financially support yourself. Since returning from my 6-month journey to South America and Southeast Asia, I have been predominantly working part-time at a restaurant so I can direct my energy on other passions such as my personal finance blog The Budget Babes.

With this choice I had to figure out alternative ways to supplement my income as the restaurant gig was only bringing in $2000-$2500 each month. I’d like to share those alternative streams of income with you now in case you’re looking to make a couple extra bucks to help with bills, savings, or anything else you’re interested in purchasing.

Maybe It’s Time For A Cleanse

Have you ever taken a step back and thought about how much stuff you have but never use? When I got back from my trip, I went through everything I owned and put a ton of stuff up on Craigslist, LetGo, Kijiji, Bunz, Facebook Marketplace, and took part in a sidewalk sale that my street was hosting. I sold clothes, kitchen supplies, electronics, sports memorabilia, candles, toiletries, and jewelry. Not only did it feel amazing to get rid of everything, I also made $500 in 2 months. One person’s trash really is another person’s treasure!

Freelance

I’ve been working on-and-off in the live events industry ever since graduating from George Brown College with a Sports and Events Marketing certificate. The events industry is small, and I now have an awesome network of connections that can often find me weekend work or smaller contracts. Although the hours are usually long, the money is quite good and the people you work with are great. And there are always events going on in every city. My advice? Reach out to the organizers to see if they need any help with ticketing or backstage work. It’s a great way to make some extra coin, and you’ll get to work in a new field that’s fun and exciting.

Sell Things

I know someone whose 18-year-old cousin went to Thailand last year and bought a ton of fidget spinners for 10 cents each. He then created a Shopify account, sold those fidget spinners for $4.00 each, and is now sipping Pina Coladas on the shores of Tahiti. Ok, the last part isn’t true, but still! He found a product that he believed in, bought in bulk, and created a small side business that made him some serious extra cash. I wasn’t that thrifty, but I did make an extra $600 this year selling new electronics that I bought in bulk.

Create a Side Business

Have you always dreamt of owning your own business? I had. So this past year, I grabbed the bull by the horns and became an Arbonne consultant to supplement my income and do something different. It’s nice to make an extra $100-$300/month working 8-10 hours on your own time when you’re passionate about a product. On top of that, I started to do social media for Minicards Toronto. This extra money can be put into my savings and invested. Which brings me to my last point…

Invest

If you’ve read any of my other articles, I am constantly talking about investing. It’s one of the most valuable tools that I’ve taken the time to learn about and has also been the most lucrative. Creating a passive income that you don’t have to work too hard for is so rewarding. For those of you who are new to the investing world and don’t know where to start, Wealthsimple is a really great platform. They will set you up on a plan that works for you depending on your goals, and will teach you the basic principles of investing along the way. If you use this link, Wealthsimple will waive the management fee for the first year, which could save you $100’s (depending on how much you’re contributing).

With all of my side businesses, freelance work, investments, and restaurant income, I’m currently sitting at just over $45,000 in after tax income as of October 2017. One of the best parts about it all is that I get to make my own hours (for the most part). You just have to be smart with your money and think of some alternatives outside of the typical 9-5 job. If you want to learn more or just reach out to say hey, you can check out my personal finance blog The Budget Babes.

Do you have any other suggestions on how to make more money now? Share them in the comment sections.

Featured Image: Flickr/Ryan Morse

Posts you might be Interested in:

The Best Apps to Track Your Money & Budget

A Forbes 30-under-30 CEO Shares 5 Apps that will Actually Make you Money

This is How Much Money you Need to Make to Afford Living in Toronto

How I Grew my Savings to $100,000 by my 30th Birthday

6 Money Hacks That’ll Help you Save More

In a city like Toronto where the cost of living is so high, working multiple jobs has become the new normal for millennials. The gig economy isn’t just an optional opportunity for those who want to make some extra cash on the side, but rather the side hustle movement is the only way some people can afford to live comfortably.

Just because the clock strikes five doesn’t mean it’s quitting time. For those working multiple jobs, it’s only a brief break before one has to refocus and go to their second job for the rest of the night. And when he or she finally gets to bed around midnight or later, they only have a few short hours of rest before it is time to wake up and start the entire process all over again.

While working multiple jobs isn’t uncommon, people do it for a variety of reasons like saving money, paying off debt or gaining further experience in an industry — precarious employment isn’t necessarily easy. Between the early mornings, late nights and the overwhelming amount of responsibilities to keep track of, it’s difficult to find a balance between fulfilling your commitments to those jobs and still maintain your sanity.

With that in mind, here are a few pro tips for helping those juggling multiple jobs.

Find dissimilar jobs.

If you’re going to work multiple jobs, it makes sense to have each one different from the other. Whether it’s a different industry entirely or a slight shift in role responsibilities, working dissimilar jobs is ideal because it mixes up your routine.

When you aren’t doing the exact same thing at every job, you’ll find you’re less bored and have more energy as you transition between your gigs. Even if you work both jobs in the same day, you’ll likely have much more energy if your side hustles vary. Sometimes the mix of a physical job with a desk job is just the right combination people need in order to effectively work so many hours in a day.

Try to simplify life tasks.

When work life takes over, sometimes living a healthy, balanced life can become more of an afterthought. So find ways to simplify everyday tasks such as cooking, cleaning, laundry and working out.

Don’t have time to cook each day? Meal prep. Don’t have time to go to the gym? Try using a condensed workout app that’s sensitive of your time constraint. There are little ways to simplify everyday tasks that will make your schedule run much more smoothly. Staying active and filling your body with good fuel will keep you energized as you move from job to job.

Plan ahead.

If you don’t have your work schedule meticulously organized, unexpected events can easily pop up and ruin your productivity. So to help keep your priorities straight and your sanity intact, take a few moments each weekend to plan for the week ahead. For example, maybe there’s a happy hour you want to attend Wednesday night, so you’ll need to be aware of that so you can shift the majority of your evening workload to Monday and Tuesday.

Once you have your workload evenly distributed throughout the week, you’ll be able to schedule your social life accordingly and make smart decisions should anything unexpected pop up. You’ll be able to get your work done more efficiently and still maintain time for the fun stuff.

Give yourself some time off.

With working multiple jobs you’ll often hear advice to take at least one full day off during the week. And if you have that flexibility and the schedule to do so then you most definitely should! However, not everyone in precarious employment has that luxury.

Working two or more jobs may not guarantee a solid day off every week, and even if you try to, you may not be able to shake that guilty feeling that comes up when you aren’t doing something job-related. You might not be able to block out an entire day for yourself, but you should at least give yourself a couple hours off at some point during the week. Most importantly, you need to take the time to let your mind relax.

With jumping from job to job, it’s easy to forget the value of a little R&R so when you’re not working, don’t think about work. Taking regular breaks (or at least one) will leave you feeling refreshed and make for easier transitions between work.

Remain focused on your long-term goals.

Let’s face it, working multiple jobs can sometimes be a real drag. Working 100 plus hours each week is exhausting and a lack of a social life can get to a person, but keeping one’s long-term goals in sight will help to push through.

Whether you’re working precariously because you’re trying to pay off student loans or saving for a down payment on a house or working on starting your own company — whatever your reason may be, all the extra jobs are getting you a little closer to that goal. So when you’re entrenched in the mundane day-to-day routines of your multiple jobs, it’s important to keep that end goal in mind, and remember that it will all be worth it in the end.

Featured image: Instagram/ @beproductive

Posts you might be Interested in:

The Art of the Side Hustle: 5 Realistic Ways to Make Extra Money

Here’s How You Can Get Paid to Play with Dogs

These 6 Degrees will Land You the Highest Paying Jobs

These are the Highest Paying Fashion Jobs in Toronto

Different Ways to Sell Your Clothes to Make Extra Cash

Want to save up for that next “big purchase” but don’t want to sacrifice your everyday spending? Here are 6 easy money-saving hacks that’ll remove the guilt of spending and put more money back into your wallet.

Drop

A simple way to save money on your everyday spending is through the Drop app. You connect your debit or credit cards so you no longer have to carry a loyalty card. Just spend at your favourite stores like Walmart, Tim Hortons, and McDonald’s and automatically earn points. The best part? Use your Drop points to cash in on gift cards to retailers you’re spending with already.

Ebates

Is online shopping a habit you just can’t kick? Try adding Ebates to your life! The website site gives you cash back on purchases made at all your favourite stores such as American Eagle and Amazon. Some stores even give you double cash back, which means you could be earning money spending at your favourite online stores.

Honey

Another helpful online shopping hack is Honey — a browser extension that helps you get discounts at online retailers. It works by automatically searching the web for all the coupon/promotion codes and when you’re at the checkout it allows you to easily apply the ones that save you the most. With Honey you’ll always be getting the sweetest deals and the most bang for your buck.

Overdrive

Are you a big reader? Check out Overdrive — all you need is your local library card to get free access to thousands of eBooks and audiobooks. Overdrive gives you the ease and freedom of a public library right on your phone or tablet so you can read all the newest bestsellers without having to spend a dime.

Travel Tips

A travel tip for booking great trips is to have some flexibility. Flying out on Tuesday or Wednesday is typically cheaper so if possible, plan around those days. If you’re not picky about your next vacation destination, you may have better luck booking flights based on price instead of destination. Sites such as YYZ Deals, Fly Fork, or Next Departure let you know about insanely low flights and mistake fares all over the world — which means you can get a steal of a deal to Paris. This makes vacations not only feasible on a budget, but hard to turn down!

It’s easy to be rewarded for shopping if you’re smart about how and where you spend. Definitely , ake use of these money hacks to help you be a smarter spender, so you can save money while sacrificing less.

Do you have any money hacks to share? Let us know in the comment section.

Posts you might be Interested in:

The Top 5 Apps for Money Smart Millennials

Why Ebates is the Best Money-Saving Site Online Right Now

10 Etsy Sellers Share the Secrets to Building a Successful Online Store

The Best Ways to Save Money in Toronto this July

How to Save More When you Shop Online

This year Santa brought you everything on your list and then some – you’re engaged! As many as 40% of all engagements happen between November and February. First of all, congratulations! Celebrating your relationship with your friends and family can be the greatest party of your life, but planning a wedding typically comes with an expensive price tag.

Whether you’re planning intimate summer nuptials or a grand affair, how you’re going to pay for it is the first thing you need to figure out.

Create your wedding budget

Websites like WeddingWire provide awesome wedding planning tools, including a budget template. Not only will this help you identify what costs you need to think about, these online resources also show you the average spending in each category so you can compare your spending to see if its within reason.

One of the most important things to consider when making your wedding budget is who’s paying for what. Gone are the days when the bride’s family footed the entire wedding bill. Now it’s not uncommon for both sets of parents to contribute, or for the bride and groom to manage the costs alone. Never assume anyone is paying for your wedding but you. You don’t want to plan a $50,000 event under the guise that someone else will pick up the tab, only to end up with the final bill yourself! Knowing who’s paying for what right from the start determines how much your budget is and will save you many headaches down the road.

Start saving now

The best thing my husband and I decided to do for our wedding (besides commit to spend the rest of our lives together, obviously) was begin saving as soon as we were engaged. We calculated our wedding budget, and then worked backwards to determine how much we would each have to save every month in order to afford it. We opened a joint savings account, and automatically transferred a few hundred dollars from each of our paycheques into the account every month up until our wedding. After a year of saving, we had more than enough to pay for our big day!

If your wedding is six months or more away, you might choose to stash your cash in a GIC. GICs typically provide higher interest rates than high-interest savings accounts, and locking your money up for a fixed term will discourage you from dipping into it before your wedding day.

Pay as you go

While the bulk of your wedding spending will be due on your big day, a lot of little costs and deposits can be taken care of beforehand. Try to absorb low-cost items, like your hair and makeup or your wedding stationery in your regular spending rather than taking these small amounts from your wedding savings. This will allow your savings account to grow so you can better afford higher-cost items, such as event rentals or dinner.

No matter what, remember that spending more on your wedding doesn’t make you more married! Your goal with setting a budget and saving for your big day is to have the wedding of your dreams without a bill from your nightmares.

By Bridget Eastgaard for Ratehub.ca

RateHub.ca is a website that compares mortgage rates, credit cards and deposit rates with the goal to empower Canadians to search smarter and save money.

Featured image via

In our constant quest to save money, we’ve found 35 online resources to help you live a cost-effective life because it’s not about how much money you make, it’s about how much you can save! If you look hard enough, savings can be found anywhere from the gas station to the grocery store. Here are the money-saving (and making) websites you need to know:

1. GasBuddy.com

This website helps you save on gas costs by providing user generated updates on the gas stations with the lowest prices in your city and across North America. It also hosts a Trip Cost Calculator that finds the cheapest gas stations on your road-trip route, how many gas stops you’ll need to make and approximately how much you’ll spend.

2. CardSwap.ca

This website can save you money in two ways: by providing you a network to sell unwanted, unused gift cards and a network for you to buy gift cards. The gift cards are sold at face value but for every card purchased, you’ll receive Swap Points to redeem on other gift cards. For example, a $100 Loblaws gift card will cost you $100, but you will earn 100 Swap Points. For every 1000 Swap Points you earn, you’ll receive a $10 gift card from the retailer of your choice. As a seller, you’ll receive up to 93% of the value of the gift card.

3. PriceGrabber.com

Like the headline says, shop and save on millions of products by using PriceGrabber.com‘s search technology. Simply type in the item you’re looking for, whether it be an iPhone 6 or a pair of Nike running shoes, and PriceGrabber will round-up the lowest prices of the item from across the web.

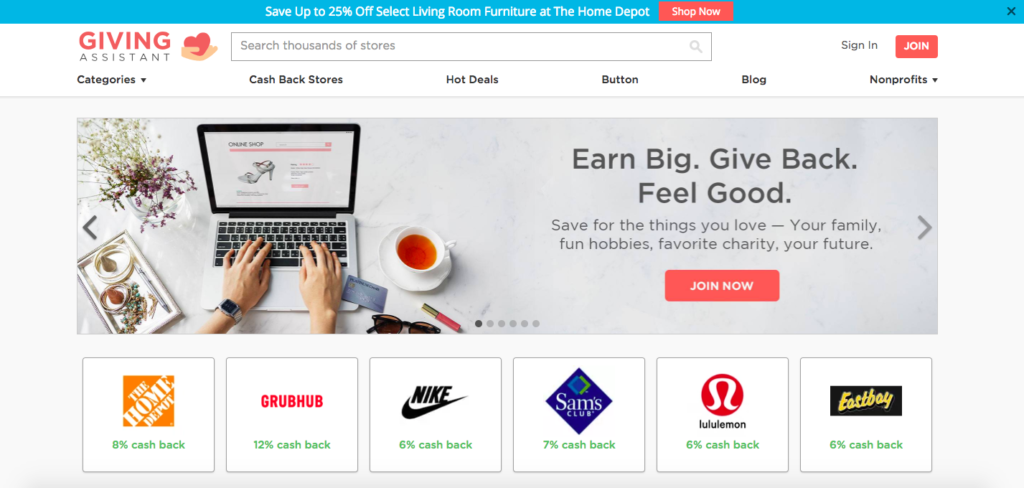

4. GivingAssistant.org

If you want to feel even better about using cash-back websites, you need to check out GivingAssistant.org. Not only does the website curate coupons and give cash back when you shop online, but they also give you the ability to donate the money you earn to its roster of 1.2 million non-profit associations.

5. Swapsity.ca

Have a skill or something you want to get rid of? Use it to barter for something you want on Swapsity.ca! All you have to do is join the website, list all of your swappables (items, things, skills, and services you want to offer) and list all of your needs (everything you want to receive). Swapsity.ca will then generate local matches and leave it up to you to discuss trades with other swappers.

6. TrendTrunk.com

We’ve spoken about the benefits of TrendTrunk.com on the blog in the past, but we’ll break it down again! Trend Trunk is a website that allows users to upload photos of their clothing & sell to members. It’s 100% free to post and once the item gets sold, you communicate with the buyer on how to ship or meet up with them to exchange the product.

7. FreeCycle.org

The Free Cycle Network is made up of a number of different groups from around the world and almost every major city has one. FreeCycle.org is where you’ll find locals giving away things they no longer need for free! You can also post things you are looking for.

8. BudgetBytes.com

We’ve praised BudgetBytes.com on the blog before, but if you’ve never checked out the website, it is a blog that focuses on simple and delicious meals you can make on a budget. Most of the meals listed cost $10 or under to make. Being frugal doesn’t mean you have to sacrifice good eats!

9. LeaseBusters.com

Thinking about getting a new car, but don’t like commitments or spending too much cash? This Canadian website is for you. LeaseBusters.com helps you find leases and almost new cars to take over (sometimes you’ll even get a few months for free) and helps lease owners find someone to take over their lease.

10. CamelCamelCamel.com

If you’re a frequent Amazon shopper, you’ve got to check out this website. CamelCamelCamel.com will send you alerts when the price of something you’re after drops, tracks the price history of any item, and rounds up the best deals of the day.

11. YYZDeals.com

This blog rounds up the cheapest flights from Toronto and neighboring airports and is updated every few days. If you don’t live in Toronto, don’t worry! The blog’s creator also has a number of Facebook pages for cities across Canada where he frequently posts flight deals.

12. DealStreet.ca

This website hosts flyers from retailers across Canada and also rounds up weekly deals. This website is great for saving money on groceries.

13. Valpak.ca

If you’ve stopped receiving those random packages of coupons in the mail, you can now grab them online at Valpak.ca! All you have to do is type in your city, pick and print!

14. StyleDemocracy.com

We don’t often toot our own horn, but if you’re looking for deals on clothing, footwear, accessories & furniture, we’re your go-to! Not only do we host our own warehouse sales (Nike, Nordstrom, Puma & more!), we share all the latest sales and deals from retailers across Canada. Check out our event calendar to learn more about special events and join our mailing list for weekly sale updates!

15. RedFlagDeals.com

Red Flag Deals is another website that promotes coupons and flyers, however, our favorite section of this website is the forum where members talk about everything from daily deals, retail reviews, upcoming sales and more.

16. Saveland.ca

Similar to RedFlagDeals.com, this website provides coupons and flyers to their members. They also have a forum section where they discuss shopping, deals, and contests, however, Saveland.ca gives you points for every discussion and comment you make on their forum. The points can be redeemed for entries into exclusive member-only contests.

17. Supercook.com

A cooking website that narrows down recipes based on what you have in your fridge!

18. Mint.com

This website pulls all your financial information into one place so that you can track your spending and build a budget. It categorizes your purchase in real time, sends you alerts for unusual activity in your accounts and even gives you custom tips on managing your money.

19. Polyvore.com

Get savvy with your online shopping by using this website. Aside from helping you discover new trends and building neat collages, this website can search the web for your exact clothing, home and beauty needs. You can use their filters to sort items by price and by whether or not the item is on sale.

20. Reddit.com

This website literally has everything, from daily news to funny pictures, but most importantly, tips on how to save money and live frugally. The website is broken down into different subreddits, but the ones we suggest checking out are /r/Frugal, /r/Thrifty, /r/Coupons. You can get even more specific with subreddits for living frugally like /r/FrugalTO (frugal tips for people in Toronto), /r/FrugalMaleFashion and /r/FrugalMontreal.

21. SwagBucks.com

Looking to earn a little extra cash on the side? Check out this website. Earn Swag Bucks by completing surveys, testing websites, watching videos and more. Your Swag Bucks can then be redeemed in their Rewards Store for gift cards to retailers like Starbucks, Amazon, Bass Pro Shops and more.

22. Analysia.com

Get paid to test out websites on this website. All you need to get started is internet connection and a microphone! You’ll get paid $10 per test through a PayPal account.

23. StartUpLift.com

Get paid to answer questions about start-up websites. You’ll get paid $5 through PayPal for every feedback accepted.

24. Userfeel.com

If you’re super opinionated, this website is for you. Get paid $10/website through PayPal just by providing your honest feedback of a website. Once you register and are approved as a user, you’ll start getting assignments by email.

25. UserTesting.com

Get paid $10 per website tested via PayPal. Just sign-up, take an entry test and then wait for assignments to come through to your email. Each test takes about 15-20 minutes.

26. Temptalia.com

This website reviews make-up and also features a ‘Dupe List’ where you can find the best cheap alternatives to some of your favorite designer make-up!

27. BargainMoose.com

This Canadian website hosts daily deals from across the web, as well as coupons and freebies!

28. VarageSale.com

A virtual garage sale that hosts communities from across Canada. Just search for the community nearest you and start shopping – you never know what deals you could find or money you could make by selling random things from your home!

29. SimplyFrugal.ca

A money-saving blog that lists daily deals & coupons from retailers, regular coupon matching (so you don’t have to!), money-saving tips, simple DIY projects, recipes & more.

30. Checkout51.com

Every Thursday morning, Checkout 51 updates with a new list of offers. All you have to do is pick the ones you like, purchase them at any store, and upload a photo of your receipt through their mobile app or website. When your account reaches $20, they will send you a cheque.

31. Save.ca

A website that rounds up fliers, coupons, and deals from major retailers and brands. Their community section hosts contests, recipes and frugal living tips. They also have a cash-back rebate app (available on iPhone & Android) – just purchase a product on their list, upload a photo of your receipt and Save.ca will cash you out for every $5 you earn.

32. MrsJanuary.com

Another blog that rounds up coupons, deals, sales, frugal tips, recipes, and freebies across Canada and the web.

33. CanadianFreeStuff.com

An all-in-one source of coupons, coupon codes, daily deals and best of all, free samples!

34. GroceryAlerts.ca

A website designed to help Canadians save money on groceries. They host 55 different grocery store fliers into one location for easy price matching. The website also hosts a coupon trader which allows you to search for coupons you need and trade the ones you don’t!

35. ShopToIt.ca

Launched in 2005, ShopToIt.ca is one of the oldest & best price comparison websites in Canada. They host a broad range of inventory with relevent guides and shopping advice. Their iPhone app is perfect for comparison shopping on the go.

Did we miss any money-saving websites? List them in the comments section!

Want to see more posts like this? Get your fix of news, shopping tips, sales and event information on Facebook, Instagram and Twitter. Sign up to be a StyleDemocracy Insider here.

Featured image via

If you had a chance to read my article on how I managed to save $20,000 in one year while living in the city of Toronto, then you’re probably aware of the fact that I’m big into budgeting. So big in fact that I started a personal finance blog called The Budget Babes where I teach 18-40 year olds the concepts surrounding finance that we should have been taught in school. I wasn’t taught how to budget while growing up, and didn’t become financially savvy until moving to Toronto in my mid 20’s; money wasn’t something that was consciously top of mind. I had to teach myself to think differently. The following apps are great tools that can help you manage your money and track your spending so that you too can start saving for the future.

I wanted to share a few of my favourite budgeting apps with you in case you’re finally ready to grab the bull by the horns and take control of your finances.

Mint.com

As one of the most popular FREE budgeting apps out there, Mint.com seems to do it all. It has an easy to use budgeting tool that links up with your debit and credit cards (automatically inputting each transactions for you), provides you with a free credit score, tracks your bills and investments, sets financial goals, and tracks your savings.

I was considering using Mint.com but didn’t want to link my banking information to a third-party app. On top of that, if you find you have a bit of a spending problem, Mint.com may not be the best budgeting app for you. By having your cards automatically linked to the app, it takes away from using your brain to see where all of your money is going (which I think you should manually track for a month when first starting out).

Visual Budget

This is my favourite app that I’ve been using for over 5 years. It costs $7 after your first 10 transactions but is worth every penny. The design is sleek, and the overview of your income vs. expenses on both a monthly and yearly basis is a great feature to track your overall spending. It takes a little bit of time to organize your expenses when you first download it, but once you’ve customized it to fit your lifestyle, you’re off to the races. Another great thing about this app is that you have to input each transaction manually. Although some would see this as annoying, it’s a great feature for those who are just starting out and need to rewire their brain to understand where all of the money is going. Spending a few dollars here and there can add up quickly when you don’t think about it, and this app forces you to think about it. You can learn more about it on their website.

Other reputable budgeting apps

You Need a Budget (YNAB): $50/Year

Wally: Free

Level Money: Free

BUDGT: $1.99 (IPhone Only)

There are so many more apps out there and you really have to do a bit of research to find which one works best for you. Some of them cost money, while others take more time to manage. But if you’re serious about getting your finances on track, I highly recommend making the jump and using something to track your daily/monthly/yearly spending. You’ll notice that you’ll think differently once you start, and you’ll be able to reduce your mindless spending so you can begin to start saving for that emergency fund or any future financial goals you may have.

Did we miss any of the best budgeting apps? Share them in the comment section.

Posts you might be Interested in:

A Forbes 30-under-30 CEO Shares 5 Apps that will Actually Make you Money

The 5 Best Apps & Websites to Score Free Stuff

This is How Much Money you Need to Make to Afford Living in Toronto

6 Money Hacks That’ll Help you Save More

8 Ways Retailers Trick You Into Spending More Money

Growing up, my grandparents always gave me Israeli Savings Bonds for birthdays and holidays instead of physical presents. I never understood why – until I hit 18. Around my 18th birthday, all of the bonds had matured, and I was presented with a cheque for $10,000. I couldn’t believe my eyes when I saw all of those zeros! I kept thinking about all of the things that I could buy with that money, but my mom had another plan in place for me. I’m so glad that I listened to her advice.

She took me to TD and had me open a Tax Free Savings Account (TFSA) where all of the money was invested into Index Funds. At this time, I had NO idea what any of these words meant. I just thought that there was a savings account and a chequing account. If you also don’t know what these financial terms mean, you can check out my blog The Budget Babes for a more in depth explanation.

For the entire year after, I didn’t think about or look at the TFSA. I just let it sit there and allowed the market to take its course. One day, I decided to take a peek and see what was happening. I had made just over $800! And I literally did nothing all year with that money. It just sat in the account, made a 7.5% return, and compounded interest while invested in these Index Funds. Seeing the $800 return sparked my interest in investing. I had a conversation with my dad about the money I had made, and about investing in general. He told me to “make your money work for you, and don’t work so hard for it”. That saying has stuck with me to this day.

I recently turned 30 on May 23, and hit a huge financial milestone. I currently have just over $100,000 in my savings account and investment portfolio. What’s the secret you ask? I’ll tell you how I did it. Keep in mind that I don’t own a home or a car, and don’t have kids or pets.

Image: Flickr/MorboKat

Set goals for yourself and work hard.

After that first year of investing, it became a personal goal to max out my RRSP and TFSA every year. And I can happily say that I’ve completed this financial goal since the age of 19. I’ve worked in freelance within the entertainment industry, and have worked in the restaurant industry to produce an income.

Pay yourself first, and have fun after.

I know that I have a different mentality about money than other people my age do. I don’t spend a lot on material things. I go out for dinners and drinks with friends, rent a great apartment in Toronto, and bike almost everywhere I can. I spend the majority of my money on experiences, food, and travel. I have the mentality that I need to pay myself first by maxing out my RRSP and TFSA, and then I can have fun afterwards. Knowing that I have that “emergency” account makes me sleep easy at night.

Educate yourself and invest!

I know that I wouldn’t be where I am now without investing. Learn the basics, take a course, and put some money into safer investments so you can begin to understand the principles. It doesn’t need to be a lot! Start with $10/week or open up a high interest savings account to start learning about interest payments. A majority of my portfolio is invested in TD e-series Index Funds, but I hold blue chip stocks that pay out a dividend. I also hold some riskier investments, but I’d suggest staying away from “penny stocks” unless you know what you’re doing. I once lost $2000 in one day on one investment, but then made it back a few years later on another investment. So now I stick to what I know and mostly contribute to Index Funds.

Budget, budget, budget.

This is so important and will be the basis of your financial plan. Once you have a budget in place, you will see where your income is coming from, and what you’re spending money on. And if you have any “leftovers,” you can start putting them into your savings account. I am so gung-ho about budgeting that I created The Budget Babes blog to teach others the basics of personal finance. I write self-published articles outlining the basic principles that we should have been taught in school, and also offer one-on-one budgeting consultations to set individuals up on their own plan. If you’re interested in hearing more, you can email me at alanna.abramsky@gmail.com.

Featured Image: Flickr/MorboKat

Posts you might be Interested in:

How I Saved $20,000 in One Year While Living in Toronto

How to Bank on a Budget

The 5 Best Apps & Websites to Score Free Stuff

The Best Ways to Save Money in Toronto this July

A Forbes 30-under-30 CEO Shares 5 Apps that will Actually Make you Money

It became apparent to me that I had a gift with saving money after traveling to South America and Southeast Asia for 6 months without having to go into any kind of debt. I’ve always been good with putting money into a savings account, but I never realized how diligent and strict I could be. In the year leading up to my travels, I had a goal and a plan in place. And I stuck with that plan which allowed me to save $20,000 in one year while living in Toronto.

After talking to friends and family about my ability to save this amount of money, I realized that there was a lack of education surrounding the world of money and how to properly budget/save for short and/or long term goals. So in January 2017, I created a blog called The Budget Babes where I teach 18-40 year olds the basics of personal finance, and how to manage your own personal finances through budgeting. Think of me as a personal trainer for your bank account.

So — want to know how I saved all of that money?

I’ll break it down for you.

Step 1: Get a Job. In 2015, I spent the first quarter of the year working as a server, and the remainder of the year working in freelance – mostly in the live event industry. I hustled hard, worked long hours, and made decent money. I took home $50,000 after taxes.

Step 2: Budget. This is the most important thing that you’ll need in order to start saving. Take your income, and then organize your fixed, variable, and irregular expenses. Are you spending more than you’re making? I used an app called Visual Budget to track where every dollar was coming from and going to. I advise everyone to track their spending for at least one month to get a sense of where your money is going.

Step 3: Look at the Alternatives. When you have an idea of your financial goals, it’s important to start thinking about alternate ways to achieve a similar lifestyle. Do you go out for lunch every day? Daily Starbucks drinker?

Let’s do some math: $4 Coffee x 5 Days/Week x 52 Weeks/Year = $1040/year. That’s a full month’s rent for some people — and you’re spending this on coffee!

How about this?

Find a French press, make whatever coffee you want during the week, and treat yourself to that Starbucks once a week. The money you’ll save on those daily $4 coffees can go right into your savings account.

Step 4: Open a no-fee high-interest saving account.

Once your daily spending is under control, start putting that extra money into a no-fee high-interest savings account. I’ve been banking with PC Financial for 13 years because they have a no-fee chequing account and a high-interest savings account. Most of my friends are paying anywhere between $10-$15/month ($120-$180/year) for their bank accounts. Watch your savings grow faster by making the switch.

Step 5: Find a credit card with no annual fee that has a cash/points incentive.

I swear that I am not affiliated with PC Financial but I do love banking with them. I use their World Elite PC MasterCard, which gives me reward incentives towards PC products. We all love free groceries, don’t we? And when saving, every little bit helps! Keep in mind that I won’t buy something if I don’t have the money sitting in my bank account. I purchase everything on my credit card for the points, but I also pay off my balance in full every month. Some of the highest interest loan rates in Canada live in credit card land, so try to stay far away from credit card debt it if you can.

Step 6: Learn the basics of investing and pay yourself first.

Since the age of 18, I’ve made it a personal goal to max out my TFSA and RRSP every year. What can I say? I’m an investing nerd! Seeing my money grow tax-free has made me recognize the importance of investing. I want my money to work for me, as opposed to me working for it. I now have very little cash sitting in my day-to-day bank account, and invest most of my income in dividend paying blue chip stocks and index funds because it provides me with a bigger return.

The most important thing that I’ve learned from experience is to have a plan and create a budget (which is why I created The Budget Babes). This will ensure that you’re staying on track and aren’t spending more than you’re making. It’s all about making saving a priority, and having fun after you’ve stored some money aside. You can do it! But it does take a plan, some guidance, and the right mentality.

Do you have any questions about budgeting? Ask them in the comment section!

Posts you might be Interested in:

A Forbes 30-under-30 CEO Shares 5 Apps that will Actually Make you Money

How to Bank on a Budget

10 Cheap Summer Date Ideas in Toronto

These 5 Retailers have the Best Warranty Plans

The Best Ways to Save Money in Toronto this July