Have you always wanted to invest, but didn’t really know where to start? Perhaps you wanted to invest but didn’t have the minimum account balance required by a financial services company that you were considering.

Just because you are not already wealthy doesn’t mean you shouldn’t invest. It just means you need to invest a little differently. Fortunately, that is now easier than ever thanks to robo advisors such as Wealthsimple.

How Does the System Work?

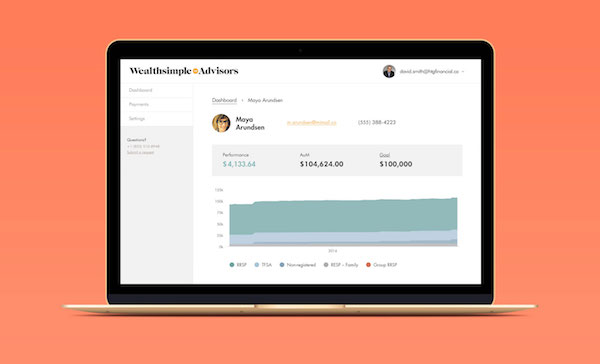

The company utilizes a technology that is quickly becoming popular in the finance field. They utilize robo advisors. These are automated advisors that will take the money that you have invested and then divvy it up between various investment options that correlate with your investment risk tolerance and the strategy that you have agreed to for your investments. If you were to put $1,000 into the account, the robo advisor would then split that up amongst several companies or types of accounts, which helps to diversify your portfolio.

This is the same sort of thing that an actual person would do, but everything is automated and simpler here. It does away with hard work on your part because you do not have to do any of the research or move any of the money around. Of course, this does not mean you won’t have access to actual people! You will still find the customer service department and people who can answer questions you might have and alleviate any concerns.

Is the System Safe?

One of main questions people have when they are considering working with a robo advisor, or just about any company online for that matter, is whether it is safe or not. While there is always a risk with the security of anything that is on the internet, you will be happy to know that Wealthsimple features 128-bit SSL certificate encryption that is considered by them to be bank-level security. The company utilizes backups and firewall technology, which can help prevent problems from occurring for their customers and on their site. Thus far, the company has not had any security problems and overall, they seem to be a safe company with which to do business.

The Main Benefits of Working with Wealthsimple

What is it about this company that makes it a good choice? Why would you choose this company over any of the others in Canada? For starters, you’ll find this is the largest robo advisor in the country, and this gives them experience that others simply don’t have. In addition, one of the best features is that you will have a very low account minimum. In fact, the account can be as low as $0.

The platform is easy to use and is well-designed, the company will pay transfer fees, it is simple to sign up even through the app, and the company has a partnership with Mint.co, which makes it easier to track your investing and budgeting. There are plenty of reasons to consider using the company to help make your investing life much easier. However, you will want to note that even though the company has very low fees, they are not the lowest on accounts under $100,000.

Consider Getting Started

As you can see, there are some very good reasons to consider using Wealthsimple as a means to help with your investments. You do not need an account balance, it is very simple set up, and you invest money when you have it. This is a very convenient way to get more and more people to start investing.

Featured Image: pxhere

Articles You Might Be Interested:

How I Made $800 In Two Weeks Using Carousell

5 Important Questions To Ask To Get Ahead In Your Finances

How To Pick The Right Credit Card For You

7 Pro Tips For Saving Money Every Time You Shop Online

How To Save Money Without Giving Up Shopping